Funding the Trust

One of the reasons to have a trust is to avoid probate, but to avoid probate you must fund the trust with your assets. Funding means: (i) transferring title or ownership of assets from you to your trust while alive, or (ii) titling assets so that ownership of the asset transfers automatically on your death to the trust. Funding your trust is extremely important. If you die and any of your assets are not in the trust your estate may have to open an expensive probate to transfer assets to your trust.

The Owner of Trust Assets

Your trust has a legal name. The legal name of your trust must state the names of your trustees, who created the trust, and the date the trust was signed. Here is an example of how to designate the trust on a beneficiary designation or as an owner of an account, real estate or any other asset:

Homer Simpson and Marge Simpson, Trustees, or their successors in interest, of the Laguna Beach Trust dated November 22, 2018, and any amendments thereto.

The following Sections are examples of how to title assets to fund your trust and avoid probate.

Bank Accounts

Bank accounts include bank and credit union accounts. You transfer cash accounts to your trust by contacting the financial institution and requesting that title to the account be changed to the name of the living trust. Although each institution has different internal procedures for changing title, most institutions will require that the change of ownership be noted on a signature card. Rather than changing title on the account to the trust, you may instead complete, sign and deliver to the bank or financial institution its form called a pay on death (POD) or transfer on death (TOD). A properly completed POD or TOD causes ownership of the account to change to the trust automatically on the death of the single owner of the account or on the death of the last owner if it is a joint account.

Investment Accounts

Investment accounts include mutual funds, cash management accounts, and the like. They are funded by initially contacting the financial institution and requesting that title to the account be changed to the name of the trust. Although each institution has different internal procedures for changing title, most institutions will require that change of ownership be completed by submitting a Change of Ownership form to the institution. This form may be a pre-printed form issued by the institution or it may simply be a letter signed by you authorizing the transaction. No matter what the format, most institutions will require the form be either witnessed, notarized, or medallion signature guaranteed. If the institution requires a medallion signature guaranteed, you must make the necessary arrangements with the financial institution to obtain this special type of signature acknowledgement.

The financial institution where you have an investment account may offer a pay on death (POD) or transfer on death (TOD) form. A properly completed POD or TOD causes ownership of the account to change to the trust automatically on the death of the single owner of the account or on the death of the last owner if it is a joint account.

Arizona Real Property

You have two options if you own real estate. You can sign and record a deed that transfers ownership of the real property to the trust: (i) now, or (ii) on your death (if single or if you own the real estate as separate property) or on the death of the second spouse. The latter type of deed is a called a Beneficiary Deed. For more on this topic read Arizona estate planning attorney Richard Keyt’s article called “Arizona Beneficiary Deeds.”

Non-Arizona Real Property

To avoid probate with respect to real estate you own that is not in Arizona you must sign and record a deed in the proper county of the state where the real property is located that transfers ownership of the real estate to the current trustee(s) of your trust.

Vehicles Registered in Arizona

You have two options, sign and deliver to the Arizona Department of Motor Vehicles a title that transfers ownership of the vehicle to the trust: (i) now, or (ii) on your death (if single or if you own the vehicle as separate property) or on the death of the second spouse. To use this to transfer title to a vehicle titled in Arizona, you must prepare an Arizona Department of Motor Vehicles Beneficiary Designation form and attach it to the title of the vehicle. This form must be stapled to and presented with the current title,and is void if altered or erased.

Warning: Retirement Plans & Pensions

Qualified retirement plans (“Plans”) and IRAs are special types of investment accounts that grow income tax deferred until the plan proceeds are withdrawn. Over time this special tax deferred treatment yields tremendous growth in the plan. In general, you must use special care with respect to Plans and IRAs to ensure that ownership of the Plan is not transferred to your trust. The IRS will treat a transfer of a Plan or IRA to a Trust as a distribution, and the full value of the plan will be treated as ordinary income (unless it is a Roth) subject to immediate federal income tax or over a period not more than five years after the funds are paid out to the trust. Therefore, the preferred method of funding Plans and IRAs is to name the trust as the contingent beneficiary of the plan in case the primary beneficiary or beneficiaries die before the Plan or IRA owner.

For years commentators have been debating the merits of naming the spouse or naming the trust as the primary beneficiary of the Plan or IRA. There are several schools of thought on the issue. In either case, the primary beneficiary can disclaim the Plan or IRA benefits to the contingent beneficiary on the death of the participant. However, there are advantages and disadvantages to both methods.

Making the proper beneficiary designations for Plans and IRAs involves many complex tax and individual family issues. It, therefore, is difficult to make a recommendation without further consultation. You have many trade-offs to consider in naming your beneficiaries – tradeoffs that affect your required minimum distributions and the taxation of your benefits after your death. You should never change the beneficiary designation of any Plan or IRA without first carefully considering the ramifications of the change and if necessary, modifying the provisions of your trust to reduce or eliminate any adverse tax consequences arising from the distribution of retirement or IRA funds to your trust.

Stock

Stock certificates that a person holds in their individual capacity are generally funded by either retitling the stock in the name of the trust or by adding a Transfer on Death (TOD) designation to the stock so that it passes to the trust on death. If a person holds their stock in a brokerage account, then the assets are funded in accordance with the instructions above on Investment Accounts.

Perhaps the most conservative method of funding stock certificates is to formally change the ownership of the stock to the trust. A Transfer on Death (TOD) designation will result in the certificates being retitled after death and generally should not trigger a probate proceeding to effectuate the transfer. However, a major limitation of a TOD designation is that it provides no protection for you if you become incapacitated because the stock is not owned by the trust. A financial power of attorney may help to render some protection in the event of a disability, provided the transfer agent accepts the power of attorney.

Life Insurance

Funding life insurance can involve the transfer of ownership of a policy, the change of beneficiary designation of a policy, or both. As a general rule, ownership of a policy is usually changed when the policy has a cash value. By transferring ownership of the policy into the trust, a successor disability trustee could access the cash value or other rights under the policy in the event the trustmaker is incapacitated.

If there is no cash value in the policy, it may still be a good idea to transfer the ownership of the term policy to the trust. Many term policies allow the policy to be converted to a whole life policy without the need to verify insurability. In the event of the trustmaker’s incapacity, if the term policy is owned by the trust, the trustees could exercise the right to convert the policy to a whole life policy.

You change ownership of a life insurance policy by: (1) completing the company’s change of ownership form, and (2) attaching a change of ownership instruction letter signed by the policy owner. Consult with your insurance company as to its specific requirements.

Regardless of whether there is cash value, the beneficiary designation is generally changed to name the policy owner’s trust as the primary beneficiary. A single person who has a trust should submit a beneficiary form to the insurance company that names the trust as the beneficiary on the person’s death.

A married person who has a trust agreement provides that on the death of the insured the trust divides into two subtrusts, one to hold the surviving spouse’s assets (the “Survivor’s Trust”) and the other to own the deceased spouse’s assets (the “Family Trust”), the beneficiary designation should name the Family Trust as the beneficiary or one or more other beneficiaries if the insured does not want the proceeds to go into the Family Trust. This will allow the insurance proceeds to receive the benefits of estate tax planning, creditor protection, bloodline protection, and values promotion contained in the trust. You change the beneficiary designation on a life insurance policy by: (1) completing the company’s change of beneficiary designation form, and (2) attaching a change of beneficiary designation letter signed by the policy owner. Consult with your insurance company as to its specific requirements to designate a beneficiary of your life insurance.

Many employers provide group life insurance as an employee benefit. If your employer provides such benefits, you must contact your company’s human resources department for the appropriate forms necessary to change the beneficiary. Generally, the ownership of a group policy cannot be changed. Although most group policies will allow the beneficiary designation to be changed to name the trust.

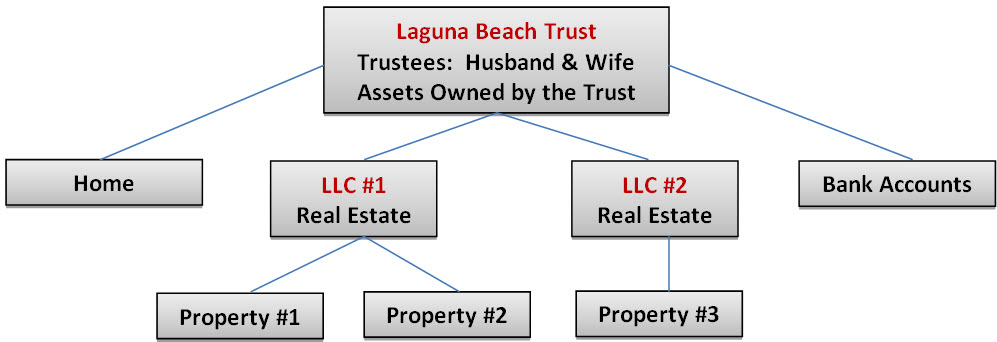

Diagram Showing How a Trust Owns Assets

<< Chapter 7 Trusts Explained from A to Z

Chapter 9 Trustees Explained >>