Our Biggest Risk – The Ultimate Nightmare

The biggest risk we all face is a traffic accident that we cause that results in the death of another person. If this happens we will be sued by the family of the victim and if the family wins a judgment that exceeds the insurance policy coverage all of our assets could be lost.

The ultimate nightmare arises when a spouse is driving and causes an accident that kills the other spouse and kills or injures a pedestrian or person in another car. Without a properly created trust and beneficiary planning all of the couple’s assets could be lost. However, with proper planning the assets of the deceased spouse and life insurance on the deceased spouse can be asset protected for a surviving spouse who suffers the ultimate nightmare.

Spouse is Driving a Car and Causes an Accident in which the Other Spouse and another Person are Killed

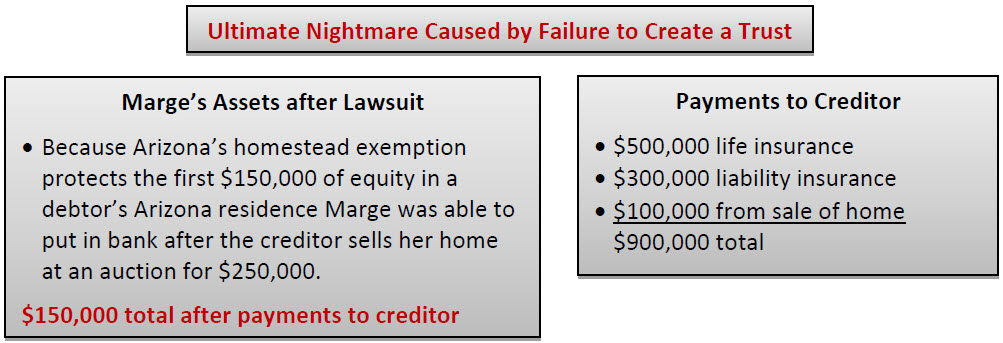

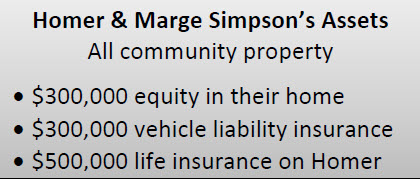

Arizona residents Homer and Marge Simpson own their $300,000 home free and clear as community property with right of survivorship. Their only other asset is a $500,000 term life insurance policy on Homer’s life. Marge is the beneficiary. While driving the family car Marge causes an accident that kills Homer and a person in another car. Their auto insurance policy provides $300,000 of liability insurance coverage. The wife of the deceased accident victim sues Marge and gets a judgment against Marge for $1,000,000.

The illustrations below show the dramatic economic difference to Marge between having a trust and not having a trust. Asset protection for your spouse or loved ones is the number one reason why married people and life partners should have a trust.

Couples Should Create a Trust that Provides for the Division of Assets into Two Subtrusts on the Death of the First Spouse or Companion

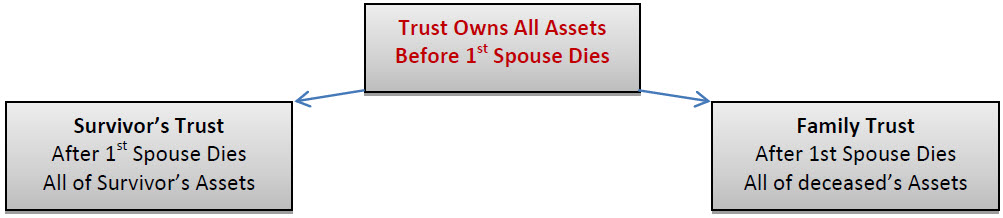

As an estate planning attorney who has been practicing law in Arizona since 1980, I have seen far too many sad economic situations following the death of a parent, spouse or companion that could been prevented if the deceased person had created a properly designed Trust and funded it while alive. The illustrations in this chapter show the night and day difference in economic results to a family when: (i) the deceased did not create a Trust, vs (ii) the deceased took action to protect loved ones before it was too late. Your spouse or companion is protected when you create a Trust that on your death divides into two trusts, an Irrevocable Family Trust that owns all of your assets for the benefit of your spouse or companion and a Revocable Survivor’s Trust that owns your spouse’s or companion’s assets.

Terrible Financial Consequences to Surviving Spouse Because the Couple Failed to Create a Trust

Surviving spouse is sued and the family of the deceased victim wins a judgment against Marge for $1,000,000. Below you see what Marge owns after the lawsuit because Homer and Marge did not create a trust that would protect Homer’s life insurance and his assets from Marge’s creditors.

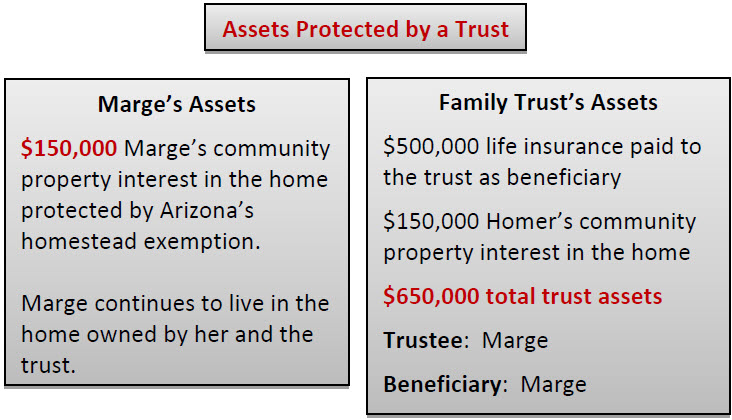

Creating a Trust that Divides into Two Trusts on Death of the First Spouse Would Have Protected $650,000 from Marge’s Creditor

If Homer and Marge had created a trust that provided that on the death of the first spouse a new second trust (the Family Trust) would be created to hold the life insurance proceeds and the assets that belonged to Homer, then Marge would have protected $650,000 that was lost to the creditor without the creation of the Family Trust.

Why You Must Create a Trust to Protect Your Family

Don’t procrastinate! Protect your family from the ultimate nightmare. Create a Trust that divides into two trusts on the death of the first spouse now before it is too late and insure that life insurance proceeds and assets of the first spouse to die will be protected from creditors of the surviving spouse.

Trusts can Protect Assets for the Family of a Single Person and a Married Person

A well designed trust will give the family members of a single person, a married person or a married couple excellent asset protection after the trustmaker’s death. When assets are held in trust for the benefit of children, grandchildren, family or friends of a single person the assets can be protected from creditors, predators and ex-spouses of the beneficiaries.

You may think your loved one does not need asset protection for his or her inheritance, but you never know what the future holds. A well designed trust can protect inherited assets in the following scenarios:

- Your loved one has a large judgment against him or her when you die or perhaps years after your death. The creditor cannot get assets held in the trust you created and funded for your loved one.

- Your married loved one inadvertently converts his or her inheritance from separate property to community property and his or her ex-spouse gets one half of the inheritance in the divorce. The ex-spouse cannot get assets held in the trust you created and funded.

- Your loved one understands how to protect his or her inheritance and keep it as separate property, but voluntarily gives some or all of the inheritance to the ex-spouse just to “make the problem go away” and stop the stress. The ex-spouse cannot get assets held in the trust.

- Your loved one has a spouse, significant other or friend that burns through money. Without a trust that you created and fund, that spouse, significant other or friend could influence your loved one to spend, spend, spend. The spouse, significant other or friend cannot get assets held in the trust you created and funded if your loved one is not the trustee if your loved one is not the trustee.

- Your loved one files a bankruptcy petition. The bankruptcy court will give the inheritance to your loved one’s creditors. The bankruptcy court cannot get assets held in the trust that you created and funded because those assets do not belong to your loved one.

- Your loved one gets government benefits that are based on his or her income and/or assets. The inheritance could reduce or eliminate the government benefits. If the inheritance is held in a trust you created and funded and if that Trust has appropriate Special Needs Trust provisions, the assets do not belong to your loved one and should not be considered by the government agency in calculating the amount of the government payments.

How to Book a Free Meeting to Get Answers to Estate Plan Questions

If like most people you have questions about Wills, Trusts and estate planning and want to learn more about how an estate plan can protect your most important asset – your family – then you should:

1. Make a free appointment with Arizona estate planning attorney Richard Keyt using our online scheduling calendar or by calling our estate planning legal assistant Michelle Watkins at 480-664-7413. Our meeting will be a phone, in office or Zoom video meeting approximately one hour in length.

2. Complete our online Gold Estate Plan Questionnaire. The Questionnaire gives us information we need for our meeting. You may have questions about the questions in the Questionnaire. We will answer your questions during our meeting. If you don't have time to complete the Questionnaire that's ok. We can go over the Questionnaire during our meeting.

If you have any questions about Arizona estate planning, the process, fees or anything else, call Richard C. Keyt at 480-664-7472 or his father Richard Keyt at 480-664-7478. There is no charge for inquiries about estate planning or estate planning documents.

<< Chapter 1 Estate Planning