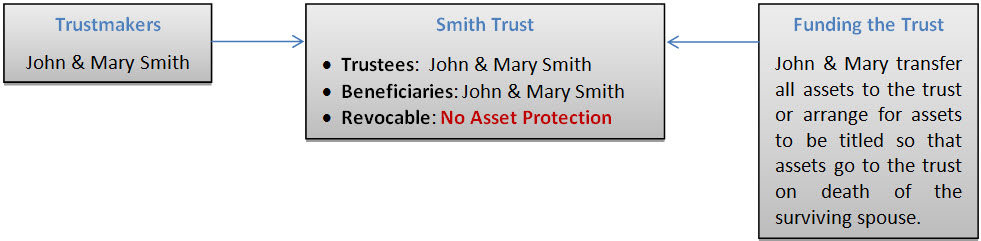

Stage 1: When the Trust is Created and Before the Death of a Spouse

The couple has complete control of all the assets in the trust until one of them dies or becomes incapacitated. The trust is revocable (can be amended or terminated) until the death or incapacity of one of the trustmakers at which time the trust moves to the second stage in its life. If the trustmaker become incapacitated the successor trustee named by the incapacitated trustmaker in the trust agreement will manage the assets in the trust for the benefit of the incapacitated trustmaker.

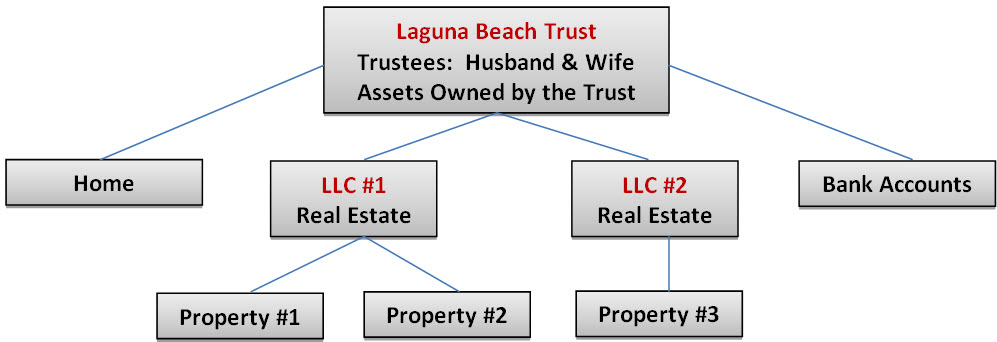

After creating the trust, the trustmakers must fund it by retitling assets in the name of the trust. The illustration below shows a typical asset ownership structure with you have a trust.

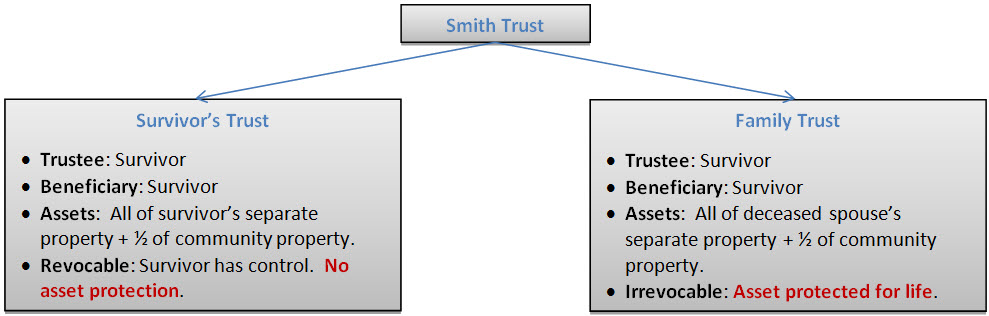

Stage 2: After the Death or Incapacity of the First Spouse

After the death or incapacity of the first spouse, the trust agreement instructs the trustee(s) to divide the trust into two subtrusts called the Survivor’s Trust and the Family Trust (sometimes called the A Trust and the B Trust). All of the surviving spouse’s property goes into the revocable Survivor’s Trust under the total control of the surviving spouse. All of the deceased or incapacitated spouse’s assets go into the irrevocable Family Trust and that spouse’s distribution plan cannot be changed. If the value of the deceased spouse’s assets exceeds the federal estate tax exemption amount of $13,920,000 the excess assets will go into a third irrevocable subtrust called the Marital Trust. For more on what happens when the estate of the deceased spouse exceeds $13,920,000 go to Chapter 14 Federal Estate Tax.

Assets in Family Trust are Protected

The primary benefit of the Family Trust is that all asset held in this trust will be asset protected for the life of the beneficiary or beneficiaries. This is the main reason to create a trust, i.e., to provide asset protection. The assets in the Family Trust can be used to pay money directly to the beneficiary when needed, pay the beneficiary’s expenses or buy assets such as a car or home that are owned by the trust and used by the beneficiary.

If the beneficiary ever got sued the creditor could not reach the assets in the Family Trust. If the beneficiary ever got married and divorced, the ex-spouse could not reach the assets in the Family Trust. Assets held in the Family Trust are asset protected. Assets distributed outright to the beneficiary are not asset protected when the beneficiary receives the assets.

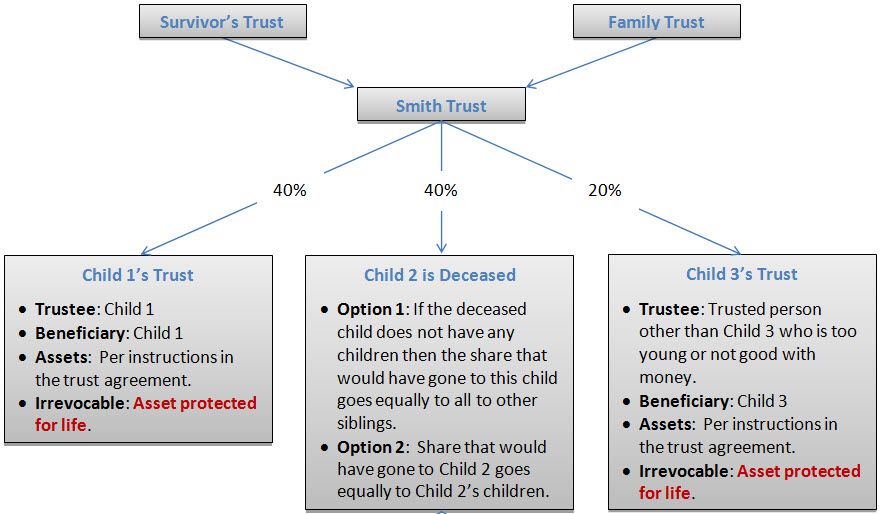

Stage 3: After the Death of the Surviving Spouse When All Children are Children of Both Spouses

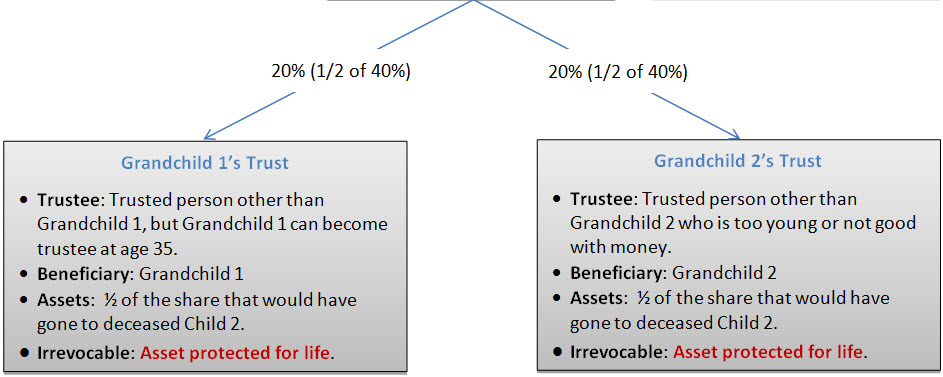

Successor Trustee selected by the trustmakers combines the assets of the Survivor’s Trust and the Family Trust into one trust for short term administration of the assets and payment of the last expenses of the second spouse to die. The trustee then creates one trust for each surviving child and each surviving child of a deceased child and transfers assets to each trust pursuant to the asset allocation instructions of the deceased couple in the trust agreement.

In the following example the trust provides that a trust will be created for each beneficiary after the death of the second spouse and assets will be allocated 40% to child 1, 40% to child 2 and 20% to child 3. All trusts are irrevocable and asset protected for the life of the beneficiary.

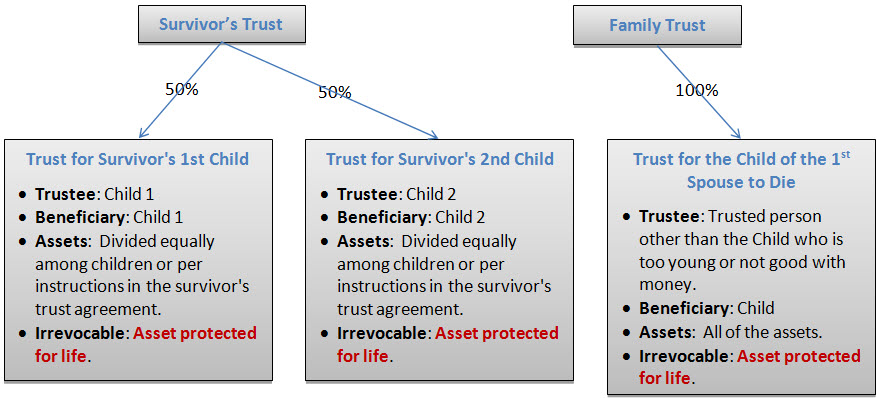

Stage 3: After the Death of the Surviving Spouse When Both Spouses have Children, but None of the Children are of the Marriage

Each spouse determines who will inherit the spouse’s assets after the death of the second spouse to die and who will be the trustee of each person’s trust. The spouses may have the same inheritance plan or they may have different inheritance plans.

In this example Bob has two children from his first marriage. His wife Ann has one child from her first marriage. Each wants to provide that their assets can support the surviving spouse, but when the surviving spouse dies, assets will go to their children. The Survivor’s Trust and the Family Trust can accomplish this goal.

<< Chapter 9 Trustees Explained

Chapter 11 What Happens to the Trust After the First Spouse Dies? >>