What is a Will?

A Will is a document signed by a person of sound mind in which the signer (called the “testator” if the signer is a man or “testatrix” if the signer is a woman) that accomplishes several important estate planning goals The Sections that follow explain what a Will does and ten reasons why people should have a Will.

Most of the Reasons to Have a Will also Apply to Trusts

As you read the ten reasons why you should have a Will below, keep in mind that all of them apply to trusts except for reason 7, naming a guardian to raise minor children. Trusts also have many other benefits in addition to the nine listed below. For example, a well-designed trust can give life-time asset protection to a spouse and other loved ones.

Reason 1: To Prevent the State from Selecting Your Heirs

First and most importantly – The Will names the person, people or entities who are to inherit the probate assets of the signer after the signer dies. The Will can name alternate heirs in the event one or more prospective heirs dies before the signer of the Will. A Will can specify alternate takers when loved ones die before you, which is not possible if you die without a Will and the law of intestate succession specifies who inherits.

Reason 2: To Make Disproportionate Gifts

If you die without a Will or a trust and the law of intestate succession of your state provides that your children inherit your property that means that all of your kids will inherit your probate assets in an equal proportion. If you want to give more to one or more kids and less to other kids you must have a Will or a trust that makes disproportionate gifts.

Reason 3: To Make Gifts of Specific Property

If you want a specific person to inherit your favorite widget then you need a Will that states that the widget goes to that person. For example if you have a son and daughter and you want your diamond ring to go to your daughter on your death then you need to state that fact in a Will or a Trust. If you do not and the law of the state gives all your property to your children then that means you son and daughter would each own ½ of the diamond ring.

Reason 4: To Disinherit a Family Member

If your state’s inheritance plan would leave some or all of your probate estate to one or more family members that you do not want to receive the inheritance, the only way to make sure those family members do not inherit anything (or inherit a share that is more or less than he or she would inherit under the state’s plan) you must sign a Will or a Trust.

Reason 5: To Give Money or Property to Charities or Nonfamily Members

If you die without a Will or a trust all of your estate will go to members of your family. If you want some or all of your estate to go to non-family members or to a charity, you must sign a Will or a trust that makes those gifts.

Reason 6: To Reduce the Risk of a Family Fight over Your Estate

When you sign a Will you are telling your family who you want to inherit your estate. One of the primary causes of intra-family fighting occurs when somebody dies without a Will. If your family doesn’t know your inheritance plan it leads to fights because one child says “Mom told me she wanted me to have the

[name your item here]” and another child says “No she didn’t. Mom said I would get the [name your item here].”

Reason 7: To Tell the Court Who You Want to Raise Your Minor Children

If you have minor children, the Will of an Arizona resident can name one or more people you chose to care for and raise your minor children if you were to die or become incapacitated. A Will does not cause children to be taken from their natural surviving parent if that parent is alive and able to care for the children. Without a Will, your death could cause an expensive legal battle among your family to convince a court to issue an order naming a family member as the guardian of your children.

Reason 8: To Distribute Assets You Acquire in the Future

A Will can specify that certain named property is to go to certain named heir(s), but it also contains a residuary clause that gives away to your named heirs everything you own at the time of your death that you do not expressly give away to named loved ones.

Reason 9: To Select the Person You Want to Administer Your Estate

If you do not have a Will that names the person you want to be in charge of collecting your assets, paying your last expenses and distributing your probate assets to your heirs the probate court rather than you will make that selection. It names one or more people as the personal representative of your estate. The personal representative is your choice to open a probate with the Arizona Superior Court, collect your assets, pay your last expenses and distribute your remaining probate assets according to your plan of distribution specified in the Will.

Reason 10: To Be Able to Change Your Heirs Over Time

A Will is revocable, meaning you can change it at any time as long as you are not incapacitated. As time passes and events in your life occur you will need to amend your Will to keep it up to date.

When is a Will Actually Used?

Although you may sign a Will now, whether you ever actually use your will depends on the future circumstances of your life. Unlike a trust that is effective when signed and used during the life of the trustmaker, Wills are intended to be used only after the signer dies and only if: (i) the signer has assets that remain in the signer’s name after death, and/or (ii) the signer has one or more minor children who need a court appointed guardian.

When I prepare an estate plan with a trust for people I also have them sign a Will that states that if the trustmaker dies and owns any assets not in the trust that need to go through probate, the personal representative of the estate will transfer those assets to the trust. The goal when people have a trust is to put all of their property into the trust or arrange for all property not in the trust to transfer automatically on death so that probate is avoided.

What is Probate?

An Arizona probate is a Superior Court proceeding the purpose of which is to allow a court appointed personal representative to collect the probate assets of a deceased person, pay the last expenses of the estate and then distribute the assets to the heirs named in the Will or if there is no Will then pursuant to Arizona’s law of intestate succession. Read Section 5.2 The Law of Intestate Succession. To learn more about Arizona probates read my article called “How to Do an Arizona Probate.”

Cost of an Arizona Probate

Some states like California have very expensive probates. Arizona probates can be relatively inexpensive. I can do a simple uncontested Arizona probate for $2,500 – $3,500. Contested probates turn a simple court proceeding into a full-fledged lawsuit and can be very expensive for all of the parties. We once represented a trust that sought to remove the personal representative of an estate. It was a two year process that cost each side over $125,000 in attorneys’ fees.

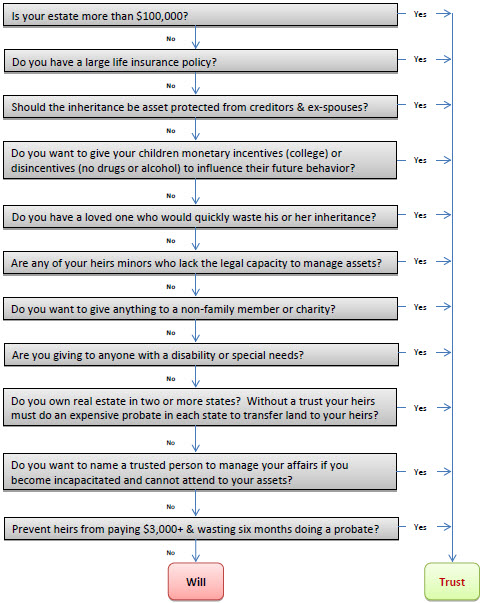

Will or Trust: Which is Best for You?

Wills vs. Trust Comparison

| Effective | On death | When signed | |

| Owner of Assets | You | Your estate | Trust |

| Who manages your assets if you are incapacitated | Your family will have to pay thousands of dollars to hire a lawyer and get a court appointed conservator to manage your financial affairs. The conservator could be somebody you would not chose. Cost: $3,000+ | A person you name in the trust agreement. Avoids wasting $$ to get a court appointed conservator. Cost: $0. | |

| Who Inherits Your Assets after your Death | Determined by the law of the state where you reside or the state where your real estate is located. | The people or charities chosen by you and named in your Will. You can name alternate heirs if somebody dies before you. | The people or charities chosen by you and named in your Trust. You can name alternate heirs if somebody dies before you. |

| Method to Transfer Assets to Your Heirs | A court proceeding called Probate. Cost: $2,500+ in Arizona, but much more in other states. | A court proceeding called Probate. Cost: $2,500+ in Arizona, but much more in other states. | You state in the trust agreement what assets go to your heirs and when the assets will be distributed. Cost: $0. |

| Property Inherited by Young People | If an heir is a minor, a person will be appointed to manage the property until the child becomes 18 at which time the child gets total ownership. | If an heir is a minor, a person will be appointed to manage the property until the child becomes 18 at which time the child gets total ownership. | Your trust agreement can provide that assets be held in trust for young people until they reach an age you select or for their entire life to give them asset protection. |

| Person in Charge of Your Probate Assets | A court appointed personal representative (aka executor), who may be somebody you would not choose. | A court appointed personal representative (aka executor) selected by you in your Will. | A successor trustee who you selected in your trust agreement. |

| Privacy | None. Probates are public records. | None. Probates are public records. | Your trust agreement is confidential. Your heirs and what they inherit is not made public. |

| Cost | None unless you become incapacitated or die then your family may have to pay thousands. | $3,000+ if you become incapacitated and your family gets a court appointed conservator. $2,500+ if your family has to do a probate to transfer your assets. | $3,497 for a married couple or $3,000 if you hire Richard Keyt to prepare your trust, Will, Living Will, Healthcare Power of Attorney, Financial Power of Attorney and other ancillary documents. |

| Asset Protection | None | None | A properly drafted trust agreement can give life-time asset protection for your heirs from creditors, ex-spouses, predators and bankruptcy. This is the primary reason to create a trust for your loved ones. |

| Incentives | None | None | You can include provisions in your trust agreement that give your heirs incentives through cash payments for accomplishments such as graduating from college or grad school, being employed full time & not using drugs. |

| Disincentives | None | None | You can include provisions in your trust agreement that give your heirs disincentives (no money or less money) if they engage in activities such as drug use or do not work. |

How to Book a Free Meeting to Get Answers to Estate Plan Questions

If like most people you have questions about Wills, Trusts and estate planning and want to learn more about how an estate plan can protect your most important asset – your family – then you should:

1. Make a free appointment with Arizona estate planning attorney Richard Keyt using our online scheduling calendar or by calling our estate planning legal assistant Michelle Watkins at 480-664-7413. Our meeting will be a phone, in office or Zoom video meeting approximately one hour in length.

2. Complete our online Gold Estate Plan Questionnaire. The Questionnaire gives us information we need for our meeting. You may have questions about the questions in the Questionnaire. We will answer your questions during our meeting. If you don't have time to complete the Questionnaire that's ok. We can go over the Questionnaire during our meeting.

If you have any questions about Arizona estate planning, the process, fees or anything else, call Richard C. Keyt at 480-664-7472 or his father Richard Keyt at 480-664-7478. There is no charge for inquiries about estate planning or estate planning documents.

Chapter 7 Trusts Explained from A to Z >>