Examples of Disasters Caused by the Lack of a Will or Trust

If you don’t have a Will or a Trust that designates who you want to inherit your assets if you die or alternate heirs in case a primary heir dies before you then your assets may not be inherited by the person or people you want to inherit the assets.

Here are some real life examples of tragic situations I have encountered because somebody died without a Will or a Trust.

Sad Example 1: Woman owned her home before she got married. She had two kids. The home is the woman’s separate property. She died without a Will or a Trust. The two kids inherit one half of the home and the husband inherits the other one half. She wanted her kids to inherit all of the home, but Arizona’s law of Intestate Succession’s inheritance plan is different from the woman’s inheritance plan.

Sad Example 2: Man and woman each owned one half of a successful business. Woman moved out of Arizona a few years before the man died. The man was the operating the company and the woman was not involved in management. The man died suddenly without any warning. Problem number 1 was the woman became the only person who could run the business, but she didn’t know anything about the business or how to manage a business. The biggest problem was the man wanted his long time live in girl friend to inherit his one half of the company, but because the man did not have a Will or a Trust the man’s one half interest in the company was inherited by the man’s brother who he hadn’t seen in thirty years and who did not get along with the woman.

Sad Example 3: A single man had five children, but only one of them worked in his business that was an LLC. The man had told his son for years that he wanted his son to inherit the LLC when he died because the son was an important reason the LLC was successful. The man died without a Will or a Trust so his five children each inherited 20% of the LLC. The son became a minority member of an LLC that was controlled by four people who didn’t know anything about the business. Unfortunately the lack of control caused the favored son to leave the business and it ultimately failed.

Sad Example 4: A single man owned one half of an LLC that operated a successful business. The man died and his three year old daughter, the mans’ only child, inherited the man’s one half of the LLC. This caused a lot of problems for the other owner of the LLC and the mother of the daughter. First problem was the LLC needed the signature of both members on a borrowing resolution required by the LLC’s bank on the LLC’s line of credit, but the daughter was a minor who lacked competence to sign a document. The mother had to spend $3,500 to get an Arizona Superior Court to appoint her as the daughter’s conservator who had the authority to sign the resolution and other LLC documents. Another problem is that the Arizona Uniform Gift to Minors Act provides that the daughter would become the outright owner of the one half of the LLC when she becomes 18. Usually people don’t want 18 year olds to get access large amounts of money or property at a young age when they might not have the experience necessary to deal with the inheritance properly. The man should have created a trust that named the daughter as a beneficiary and the mother the trustee. The mother would then have been able to manage the inheritance for the daughter until the daughter is older and wiser.

Why Multi-member LLCs Should have a Buy Sell Agreement

In examples 2 – 5 in the preceding section the members of the LLCs should have adopted a Buy Sell Agreement that gave the company an option to buy the membership interest of the deceased member or that required the company to buy the membership interest of the deceased member. This provision allows the surviving member to buy out the interest of a deceased member to avoid becoming partners with one or more people the surviving member does not want to be partners with.

To learn more about the importance of a Buy Sell Agreement for your multi-member go to my website where I have written many articles about this important topic.

Who Will Inherit Your Assets When You Die?

If you do not care who will inherit your assets then stop reading this book now and give it to somebody who cares. If, however, you do care who inherits your property when you die then you must know the inheritance plan of your state of residence because without a Will or a Trust it is the law of the state where you have property that will determine who inherits your property, not you.

You will die one day and if you have any property when you die it will pass in one of the following ways:

- Your personal property will go to the person or people specified in the inheritance plan of the state where you reside at the time of your death. Your real property will go to the person or people specified in the inheritance plan of the state where the real property is located.

- Assets that are subject to a pay on death designation or a transfer on death designation will go to the person, people or entity named in a pay on death form or a transfer on death form.

- If you have signed a valid Will the property specified in the Will will go to the person, people or entity you select in the Will, but the heirs will have to open an expensive probate in a court and the court appointed personal representative will transfer the assets designated in the Will to the designated heirs in the public probate.

- If you signed a Trust the assets owned by the Trust will go to the person, people or entity you named in the Trust without the need for a probate and with complete confidentiality.

Law of Intestate Succession

When a person owns property and dies without a Will or a Trust, that person is said to have died “intestate.” Every state has a law called the law of “intestate succession” that determines who inherits the assets of a person who is a resident of the state and who dies intestate. It is the state’s inheritance plan.

The state’s law of intestate succession may or may not coincide with your inheritance desires. If you chose not to adopt a Will or a Trust you at least owe it to your loved ones to determine if your state’s law of intestate succession will give your property to the person or people you desire.

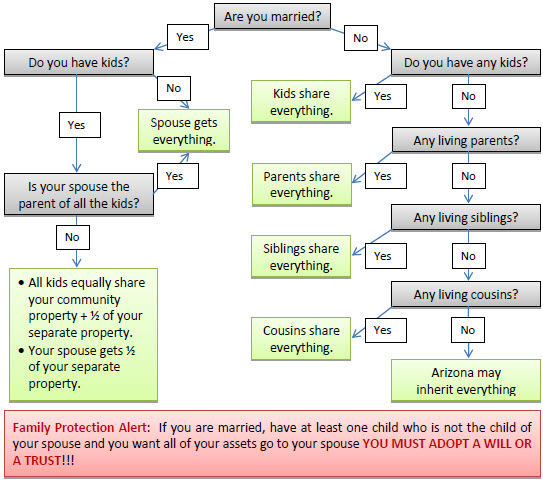

Take the Arizona Resident Inheritance Test to See Who Will Inherit Your Assets

If you are an Arizona resident follow the choices and arrows on flow chart on the next page to see who will inherit your property if you die without a Will or a Trust. Warning: Even if your inheritance plan is the same as Arizona’s one or more deaths in your family or your desires may change in the future and cause the state’s plan to differ from yours.

We also have an online who will inherit your property test for Arizona residents. When you answer the questions and click on the submit button our system will send you an email message that explains who will inherit your personal property and Arizona real property after your death and who will inherit if your primary heir or heirs die before you.

Arizona Resident Inheritance Plan

Answer the questions and follow the arrows to find out who the State of Arizona will give your probate assets to if you die without a Will or a trust. If Arizona’s heirs are not the people you want then you must sign a Will or a trust to insure that the people you chose get your property.

Intestate Succession for a Married Arizona Resident

When a resident of Arizona dies without a Will or a Trust and property of the deceased remains titled in the name of the decedent after death the law of the State of Arizona (not the decedent) determines who inherits the property of the decedent. This law is called the law of Intestate Succession and the decedent is said to have died “intestate.”

Warning: If you are an Arizona resident and Arizona’s inheritance plan is different from your plan you must adopt a Will or a Trust to insure that your desired loves will inherit your property! Don’t delay. Procrastination can cost your family dearly.

How to Book a Free Meeting to Get Answers to Estate Plan Questions

If like most people you have questions about Wills, Trusts and estate planning and want to learn more about how an estate plan can protect your most important asset – your family – then you should:

1. Make a free appointment with Arizona estate planning attorney Richard Keyt using our online scheduling calendar or by calling our estate planning legal assistant Michelle Watkins at 480-664-7413. Our meeting will be a phone, in office or Zoom video meeting approximately one hour in length.

2. Complete our online Gold Estate Plan Questionnaire. The Questionnaire gives us information we need for our meeting. You may have questions about the questions in the Questionnaire. We will answer your questions during our meeting. If you don't have time to complete the Questionnaire that's ok. We can go over the Questionnaire during our meeting.

If you have any questions about Arizona estate planning, the process, fees or anything else, call Richard C. Keyt at 480-664-7472 or his father Richard Keyt at 480-664-7478. There is no charge for inquiries about estate planning or estate planning documents.

<< Chapter 4 Family Asset Protection Checklist

Chapter 6 Ten Reasons to Sign a Will or a Trust>>