Stage 1: When 1st Created and Before the Death of the Trustmaker

The trustmaker has complete control of all the assets in the trust until he or she dies or becomes incapacitated. The trust is revocable (can be amended or terminated) until the death or incapacity of the trustmaker, but when one of those events occurs the trust becomes irrevocable and cannot be amended. If the trustmaker become incapacitated the successor trustee named by the trustmaker in the trust agreement will manage the assets in the trust for the benefit of the trustmaker.

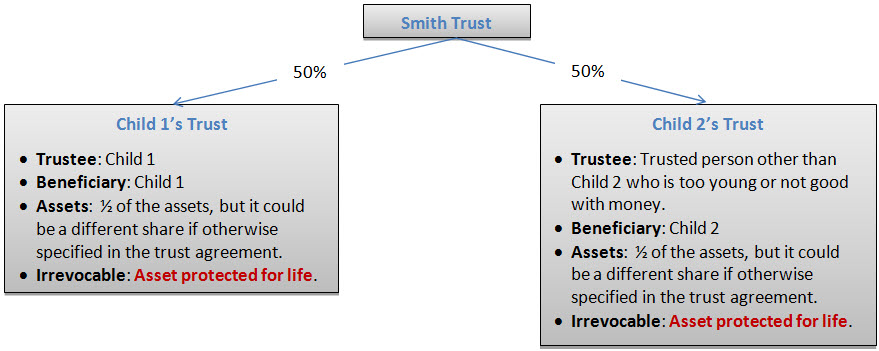

Stage 2: After the Death of the Trustmaker – All to Living Children Equally

On the death of the trustmaker the trust becomes irrevocable (set in stone) and the person or people (co-trustee) named in the trust agreement as the successor trustee takes control of the assets. The successor trustee must follow the allocation, distribution and administration instructions of the trustmaker set forth in the trust agreement. The successor trustee must create one separate trust for each heir and then transfer the appropriate amount of assets to each heir’s trust. The children’s trusts are asset protected.

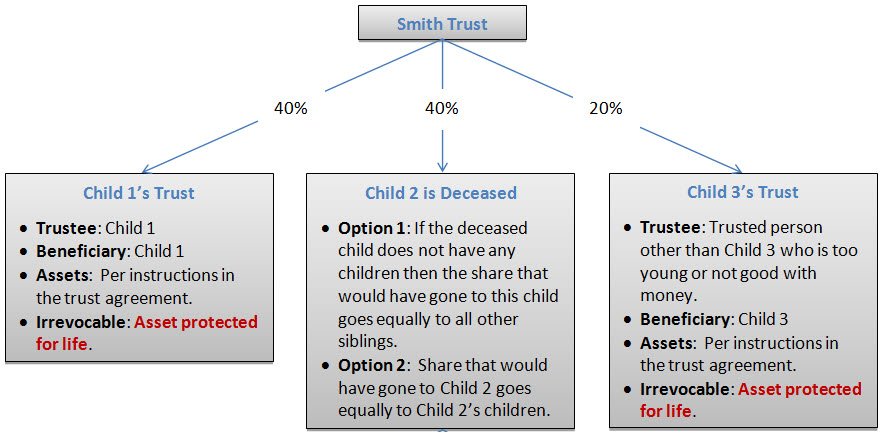

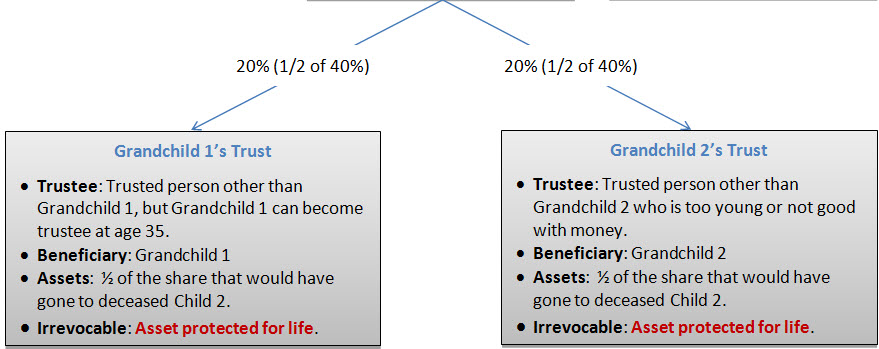

Stage 3: After the Death of the Trustmaker – Disproportionate Allocation to Living Children and Children of a Deceased Child

The chart below is an example of how a parent can provide that the assets in the trust after the parent’s death will be inherited disproportionately rather than equally by all descendants. In the example the parent has three children, but one of child is deceased and has two children who are the parent’s grandchildren. Rather that splitting the trust assets 1/3, 1/6, 1/6, and 1/3 the parent wants one child to get 20% instead of one third. The chart illustrates the result of the unequal allocation of the assets. It also illustrates that after the parent’s death, four new trusts will be created, i.e., one new trust for each beneficiary.